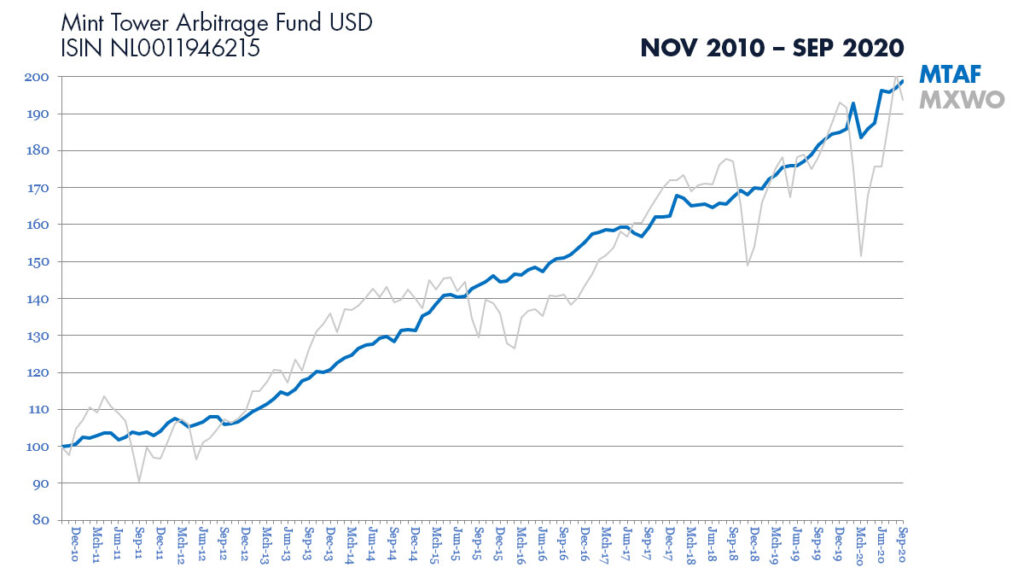

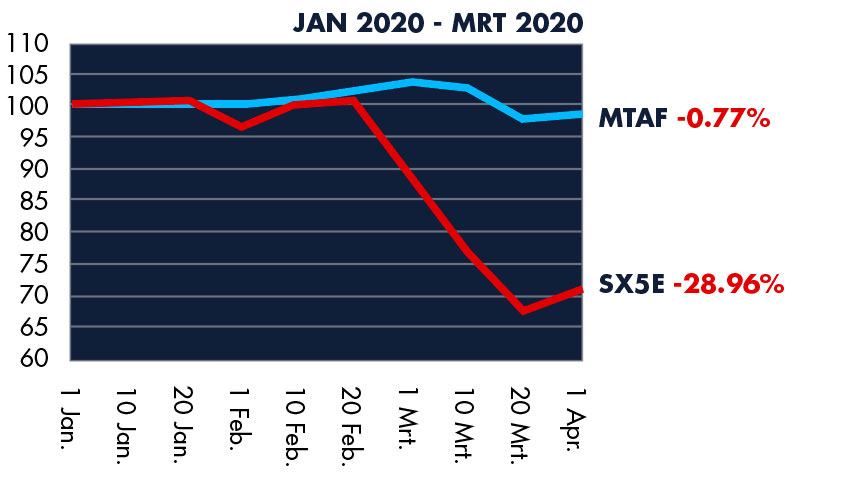

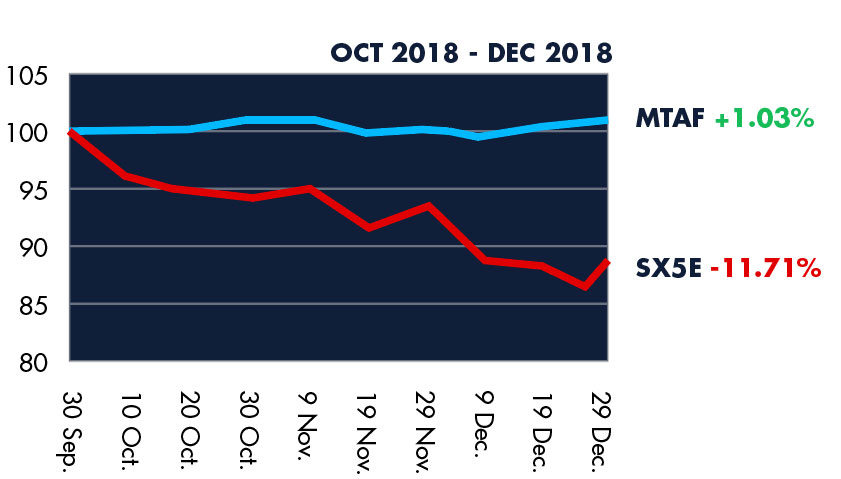

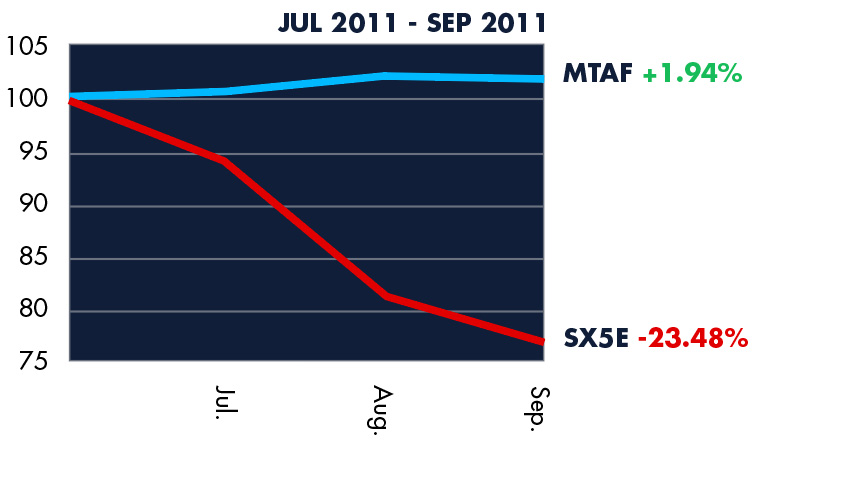

Since its founding in 2010, the Mint Tower Arbitrage Fund has achieved a positive return every year, thereby also successfully navigating the market turmoil in 2011, 2018 and 2020.

The average net annual return is 7.11%.

The fund’s objective is to achieve stable annual net returns of at least 5% on average over a 3-5 years horizon with emphasis on capital preservation under all market circumstances. This means that Mint Tower sets out to achieve such results independent of the directionality of the global financial markets. The graphs below highlight the market neutral behaviour of the fund.

The first graph shows the stable performance of the Mint Tower Arbitrage Fund (MTAF) compared to the MSCI World Index (MXWO). The other graphs zoom in on specific market events, thereby showing the clear diversification benefits provided by the fund.

Net annual returns

2011

3.45%

2012

3.73%

2013

11.78%

2014

8.87%

2015

10.03%

2016

7.33%

2017

4.65%

2018

4.74%

2019

8.82%

2020

7.48%