The fund's objective is to achieve a stable (with small monthly results) annual net return of at least 5% on average over a 3-5 years horizon with emphasis on capital preservation under all market circumstances.

Mint Tower Arbitrage Fund

Purpose of the Fund

Strategy

Mint Tower invests in volatility strategies that benefit from moves in the global financial markets. The strategies are set up using exchange traded financial instruments such as, but not limited to, equities, options and (convertible)bonds. As a result, the fund has the ability to generate returns regardless of state of the financial markets, thereby constituting an “all-weather” approach to managing its portfolio.

Volatility

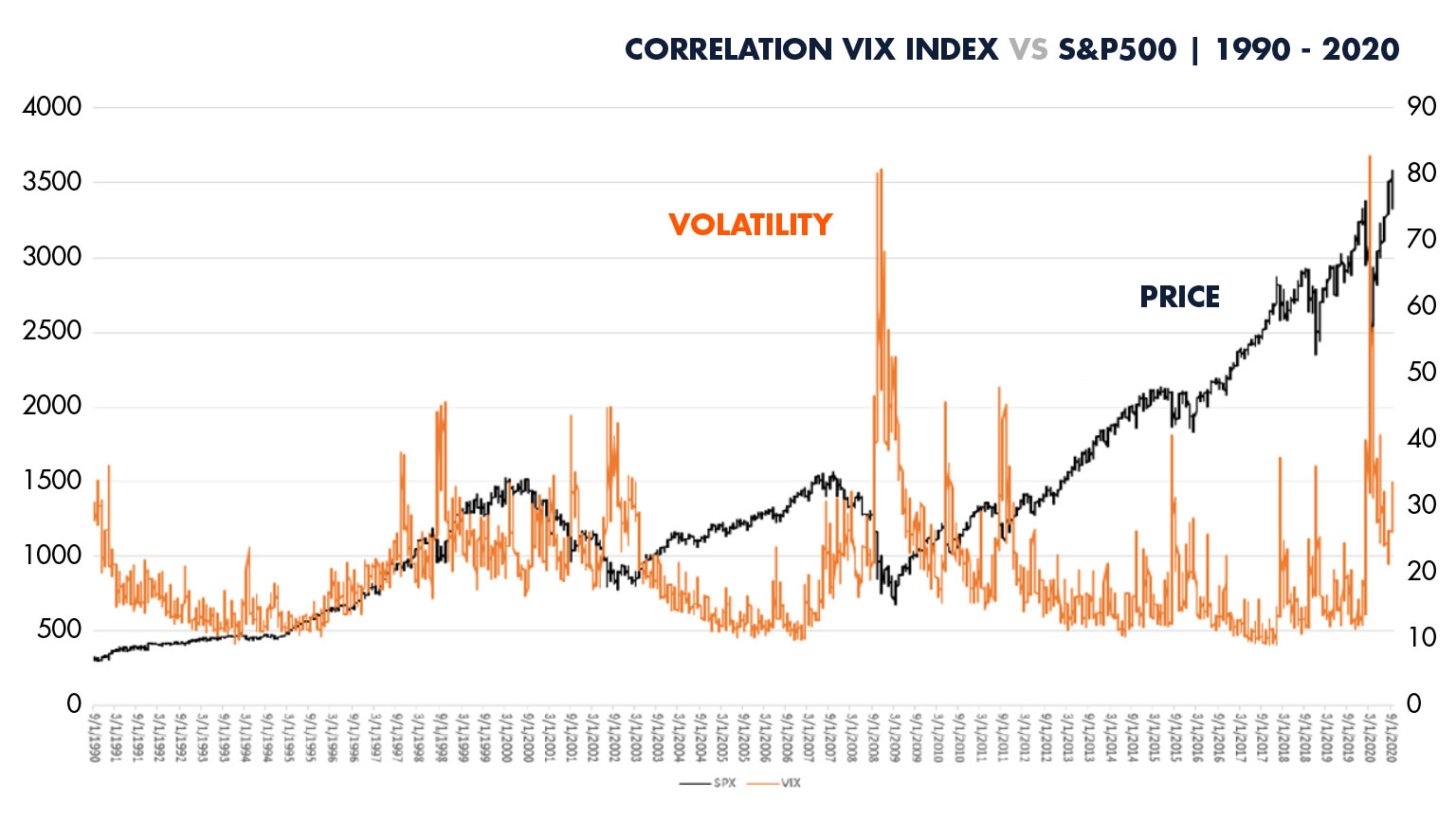

Volatility is the degree to which prices of the underlying assets (e.g. equities, bonds or indices) move or are expected to move. The VIX Index is a well-known representation of the concept. Namely, it is the expected volatility of the S&P500 Index, calculated from its 30-day options.

A volatility index serves as an indicator of the probability one can attach to an outsized move in the underlying asset. The VIX Index is referred to as the fear gauge as it reflects the uncertainty priced in by market participants. The higher the VIX Index, the greater the uncertainty (fear) about the direction of share prices. The graph below shows the correlation between the VIX Index and S&P500. In turbulent times, the level of volatility goes through the roof, while the S&P500 moves in the opposite direction.

Mint Tower is able to deliver returns in both rising and falling markets.

Capital preservation

Capital preservation is an essential pillar of Mint Tower’s approach. In the implementation of its investment policy, Mint Tower always emphasises the importance of capital preservation under various market circumstances. Minimising risks is more important for Mint Tower than maximising returns.

Supervision AFM & DNB

Mint Tower Capital Management BV (MTCM BV) is a licensed investment manager (Article 2:65 of the Financial Supervision Act) and as such is supervised by the Netherlands Authority for the Financial Markets (AFM) and De Nederlandsche Bank (DNB). Mint Tower Capital Management is included in the register of the AFM.

DNB is a prudential supervisor and focuses on sound and honest financial enterprises that meet their obligations. The AFM is responsible for conduct-of-business supervision and is committed to fair and transparent financial markets. From these two different perspectives, DNB and the AFM work closely together when assessing the management.

MTCM BV obtained the AIFMD licence, a European directive for investment institutions, in November 2015. We are thus subject to supervision by the AFM and DNB, pursuant to the applicable provisions of the Financial Supervision Act (Wft). MTCM BV and the Mint Tower Arbitrage Fund that it manages must thus at all times comply with the statutory requirements regarding expertise and reliability of the directors, financial guarantees, conduct of business and provision of information to participants, the public and regulators.

The conditions and agreements relating to the management of the Mint Tower Arbitrage Fund are also pointed out in a detailed and binding prospectus.

The risk management team includes former traders who are experienced in understanding both expected and unexpected risks.

Risk Management

Risk Management is central to all the processes at Mint Tower, pertaining not only to portfolio risks, but also to operational and compliance risks.

The importance of risk management is paramount within the fund and is reflected by the Chief Risk Officer (CRO) also being one of the partners and founders of Mint Tower.

As risk management forms an integral part of the fund, the positions are monitored continuously, in real time as opposed to retrospectively. Furthermore, we are constantly evaluating the positioning under different market conditions and scenarios. To that end, Mint Tower has various specialized systems which optimally analyze the valuations, risks, and correlations between portfolios.